You are a business owner. You and your team take time to understand your customer’s needs and you diligently deliver a stellar service.

In your business, you take pride in what you do. For your hard work, you prepare and send out your invoice to your customer in a timely manner in the hope that you will be paid swiftly. Then, as you are super busy, you move on to serve your next customer. But, six to eight months down the line, you realise that you still have not yet been paid for your earlier invoice.

How did you and your team not notice the unpaid invoice?

Why was the unpaid invoice not spotted earlier?

What could you and your team have done better?

How can you try to ensure that your invoice is paid on time moving forward to try and ensure that cash flow is not impacted?

Many companies are experts at what they do but when it comes to getting paid, sometimes being busy can often mean that invoices aren’t raised frequently and whether or not they are paid is rarely considered until cash flow becomes a problem. This is especially true for new businesses and in particular smaller businesses with limited personnel.

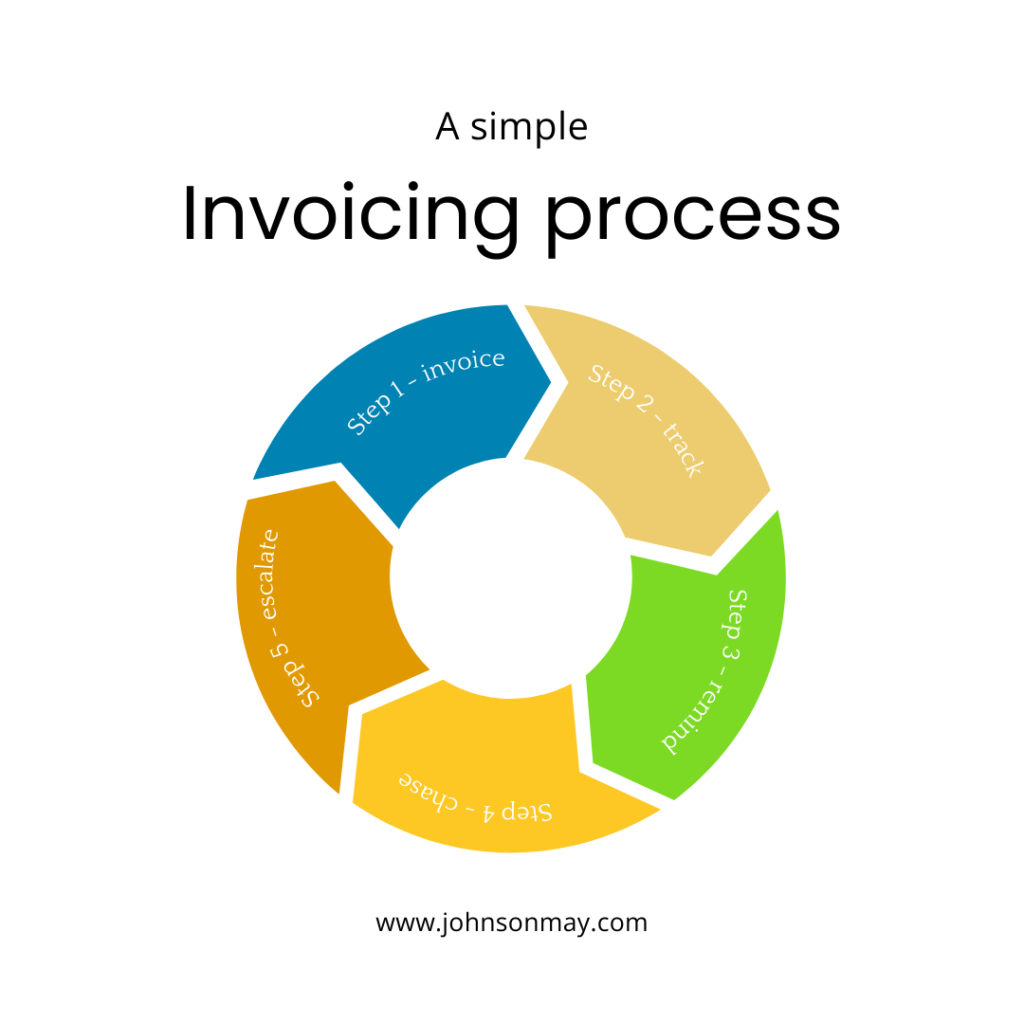

We would recommend that a simple invoicing process is put in place as soon as possible to combat these issues.

Here is a simple invoicing process for you to implement into your business: –

Step 1 – invoice

Step 2 – track

Step 3 – remind

Step 4 – chase

Step 5 – escalate

Step 1 – invoice

Ensure that your business terms and conditions mirror your business processes and as soon as the trigger for payment arises, raise your invoice and send it promptly.

You can take a look at the government’s guidance on invoicing and taking payments from customers here.

Step 2 – track

As soon as your invoice has been sent, track when payment is due.

Step 3 – remind

Before the invoice is due to be paid, send a payment reminder. For example, if your payment terms are 30 days, send a reminder before payment is due. Reminders can sometimes result in invoices being paid earlier.

Step 4 – chase

In the event of an unpaid invoice, do not be afraid to chase payment.

Send a polite email to your customer alerting their attention to the fact that your invoice has not yet been paid.

Call your customer to check that they have seen your invoice and to find out when they will pay. Your customer may have delegated the task and it may still be sitting in someone’s “to do” list.

Step 5 – escalate

Do not allow an unpaid invoice to remain unpaid for substantial periods of time. If you have followed steps 1 to 4 and you still have not been paid, you may need to stop working for that particular customer. It may be time for you to get help from a debt recovery solicitor.

How we can help you

Johnson May solicitors, are debt recovery agents and we are offer low fixed fees to help our clients get invoices paid.

We are based in Beckenham, London but we service clients throughout England.

Our debt recovery process follows an approach that champions communication to recover payments swiftly for our clients.

Make a free enquiry

Call us on 020 8150 7171, email info@johnsonmay.com or complete our Free Online Enquiry for a free, no-obligation discussion and let us explain your legal rights and options.